Partner with us

You don’t need all the right answers — just the right solution.

Clue helps you say ‘yes’ when your clients need more. We deliver tailored commercial lending solutions backed by property, designed with your client’s unique needs in mind.

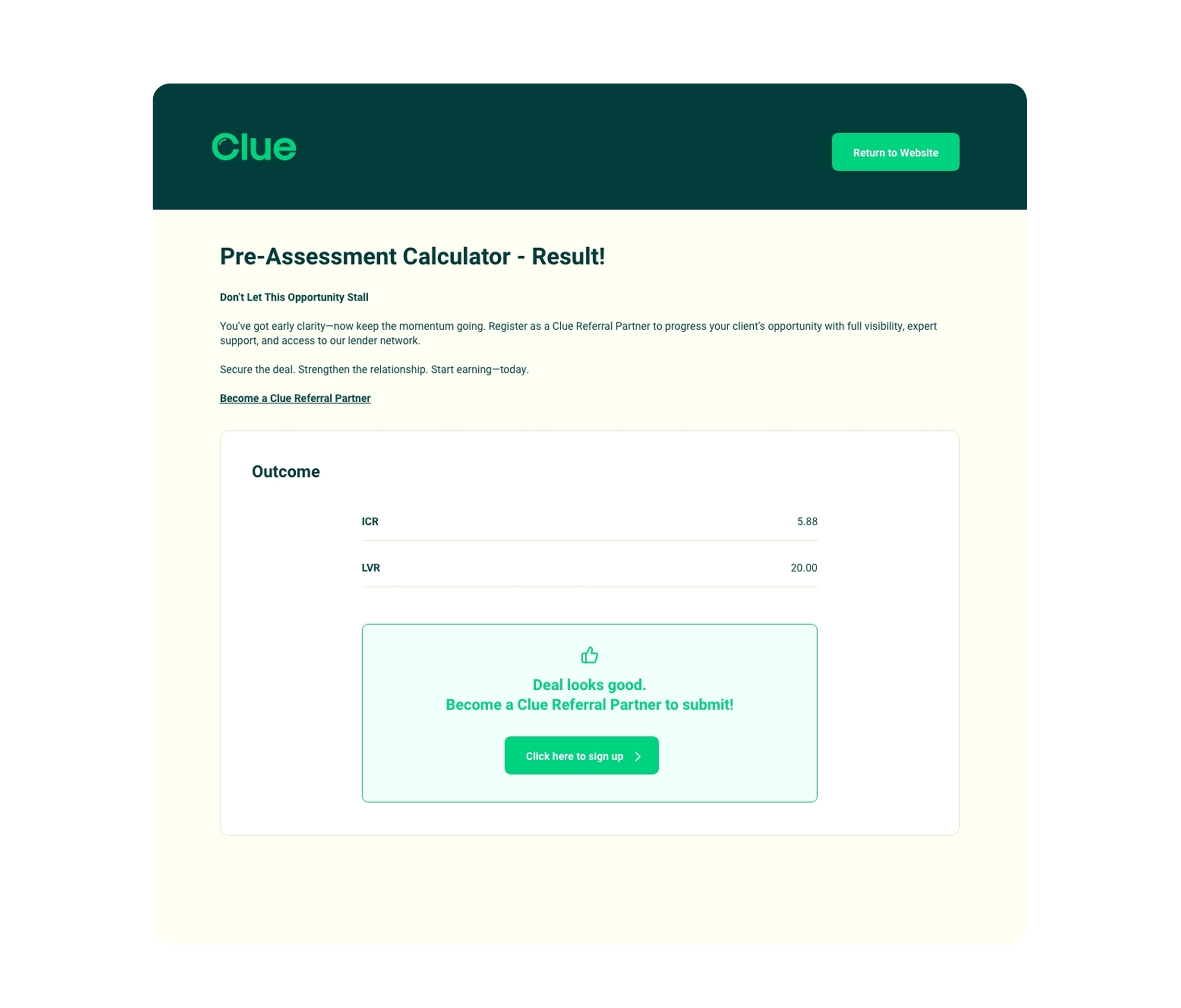

Pre-qualification

Step 1: Refer Your Client

To lodge an application, you’ll need:

- A registered ABN for the borrowing entity

- The address of the security property

No problem. Use Clue’s easy pre-qualifying tool to get a sense of the likelihood of success based on what you do know. When you’ve gathered the missing information, you can reopen your saved pre-qualified lead and submit the full opportunity seamlessly.

This flexibility allows you to move at your client’s pace—while keeping deals on track and under your control.

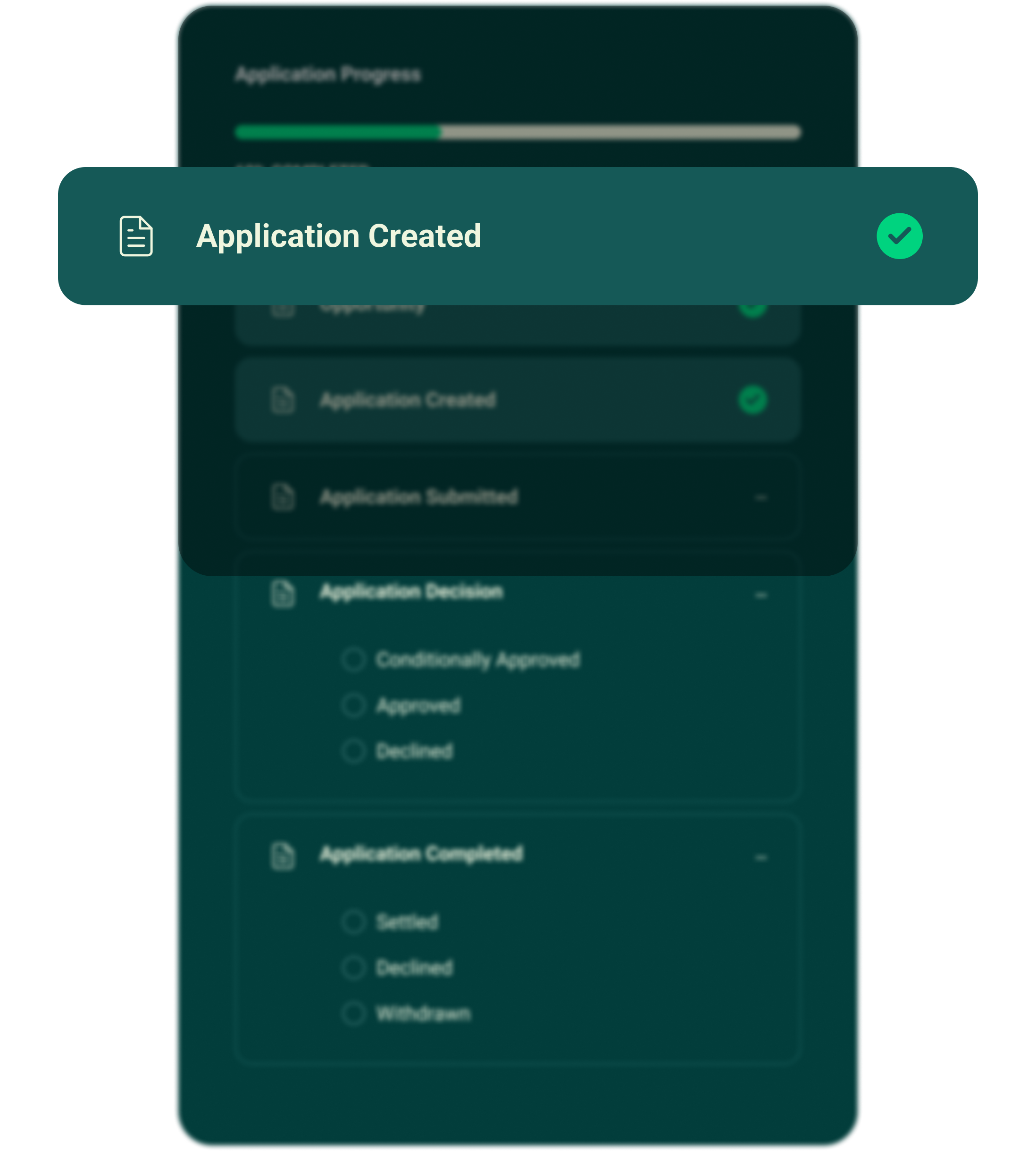

Step 2: Application Created

Once your opportunity is submitted, the Clue team springs into action. Within 48 hours, your application is reviewed and confirmed—giving you clarity on next steps.

You won’t be left guessing or chasing updates. At this stage, a Clue Finance team member will contact your client directly to validate the information provided and formalise the application with our lending partners.

This means your client receives a professional, lender-ready experience—without you needing to manage the back and forth. You stay informed and in control, while we handle the heavy lifting.

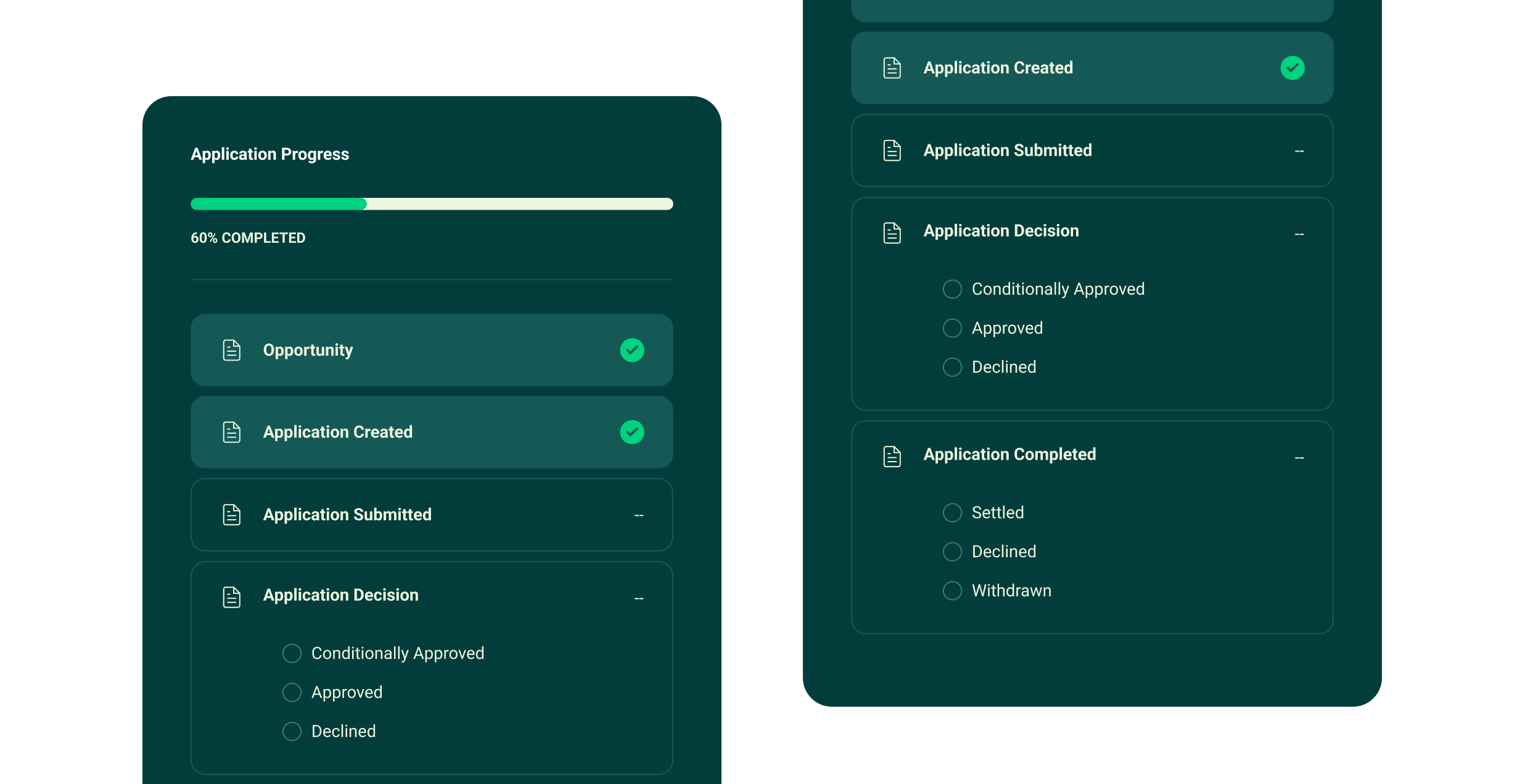

Step 3: Track Progress in Real-Time

Step 4: Receive a Tailored Outcome

Our commercial finance experts source tailored solutions from Clue’s extensive panel of banks, non-banks, and private lenders. We don’t just find a lender—we find the right lender for your client’s needs.

From formal application to final offer, we’ll guide your client every step of the way—ensuring a smooth, informed experience, while keeping you in the loop.

Step 5: Deepen Client Trust

Why Professionals Choose Clue

- End-to-end transparency

- Clear timelines and updates

- Expert support from bankers-turned-brokers

- Access to all lender types (bank, non-bank, private)

- Revenue opportunities, without extra workload